Investor sentiment remained weak in the Indian equity market for the fifth consecutive week amid US’ tariff war and the ongoing earnings season. New-age tech stocks under Inc42’s coverage remained under pressure for the second consecutive week in line with the broader market trend, falling in a range of 0.90% to about 9%.

Overall, 22 new-age tech stocks ended in the red this week, with MobiKwik emerging as the biggest loser. The fintech company’s shares tumbled 8.65% to end at INR 234.35 in a week when it reported yet another disappointing set of quarterly financial numbers.

ideaForge was the second biggest loser this week, with its shares sliding 8.15% to end the week at INR 433.75. On July 22, the company reported a85% YoY fall in its operating revenue to INR 12.8 Cr for Q1 FY26. Net loss rose to INR 23.6 Cr. The stock has crashed over 20% since the company declared its Q1 numbers.

Fino Payments Bank’s shares also stumbled 6.37% to end at INR 255.10 after the company reported a 27% YoY decline in its net profit to INR 17.7 Cr this week.

It was followed by Swiggy, with the stock falling 3.80% to close at INR 392.30 on August 1 (Friday). The foodtech major’s shares came under pressure after its Q1 loss surged 96% YoY to INR 1,197 Cr. Top line zoomed 54% YoY to INR 4,961 Cr.

Online travel aggregator EaseMyTrip’s shares continued to fall, touching a fresh 52-week low of INR 9.77 during Friday’s trading session. The stock ended the week 4.93% lower at INR 9.83. The company’s shares have plunged over 37% year to date.

Meanwhile, 13 new-age tech stocks under Inc42’s coverage gained in a range of 0.02% to close to 1% this week. Shares of CarTrade zoomed 14.69% to end the week at INR 2,176.50, after it reported yet another profitable quarter.

PB Fintech, Go Digit and Delhivery were among the other companies which declared their financial numbers during the week and saw their shares rise. Notably, Delhivery released its Q1 numbers after market hours on Friday.

Meanwhile, shares of EV manufacturer Ather Energy, which is set to disclose its Q1 earnings on August 4 (Monday), also jumped this week. The stock gained 4.06% to end the week at INR 347.25. During the week, brokerageHSBC initiated coverage on Ather and gave a ‘Buy’ rating with a price target of INR 450.

Managed office space provider IndiQube became the latest addition to Inc42’s new-age tech stocks this week, after the company’s shares made a muted debut on the exchanges on July 30 (Wednesday). After listing at a discount of about 8% from its issue price at INR 218.7 on the BSE, the stock fell 0.57% further to end the week at INR 217.45.

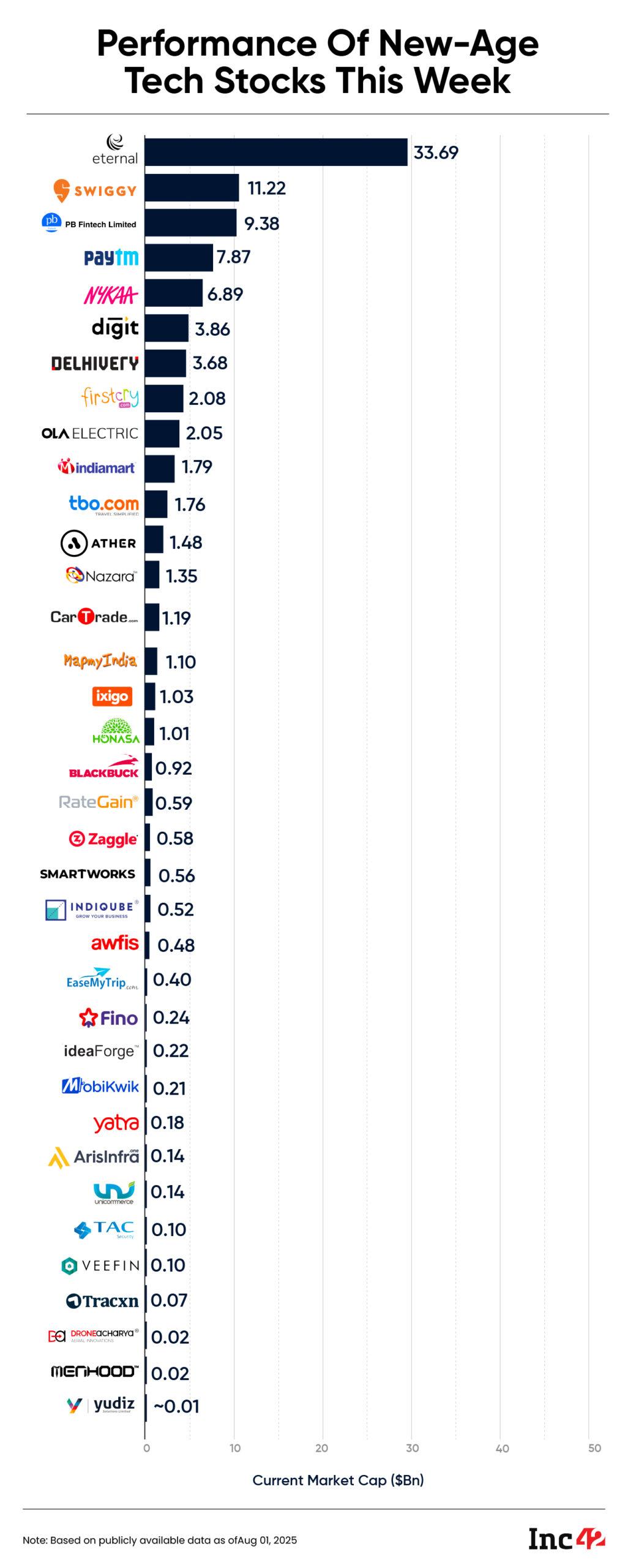

With the new addition, the total market cap of the 36 new-age tech stocks stood at $96.93 Bn at the end of the week as against the $95.82 Bn m-cap of 35 stocks at the end of last week.

Now, let’s take a look at the broader market trends.

US Tariffs, Weak Earnings Weigh On MarketThe Indian equity market extended its loss for the fifth consecutive week as fresh turmoil on the geopolitical front and weaker-than-expected earnings resulted in selling pressure. While Sensex declined 1.5% to 80,218.52, Nifty 50 plunged 1.3% to end the week at 24,512.20.

Like last week, the earlier part of this week saw a relatively stable market tone. However, investor sentiment turned negative after US president Donald Trump announced the imposition of a 25% tariff on imports of Indian goods from August 1 amid prolonged trade negotiations between the two countries.

In addition, the Trump administration also said that there will be an unspecified “penalty” on India for its purchase of military equipment and oil from Russia

“This development not only reignited fears of a potential trade standoff but also raised concerns over its impact on India’s export-dependent sectors. The announcement came at a time when markets were already grappling with hawkish central bank commentary, sustained foreign fund outflows, and a relatively underwhelming earnings season,” said Ajit Mishra, SVP of research at Religare Broking.

Going forward, analysts believe that investors will keep a close watch on the RBI MPC meeting next week even as risks remain tilted to the downside. A stable inflation outlook, potential progress in trade talks with the US, and selective strength in domestic sectors are anticipated to lay the groundwork for a recovery.

CarTrade Drives To New HighsThe ecommerce company declared its financial results for Q1 on July 28 (Monday), leading to an extended bull run that persisted almost the entire week. CarTrade’s shares touched an all-time high of INR 2,218 on July 31 (Thursday), before settling down at INR 2,176.50 by the end of the week. The stock is up 43% year to date.

CarTrade’s profit surged 106% YoY to 47 Cr in Q1, while revenue rose 27% YoY to INR 199 Cr.

Its consumer group’s revenue grew 32% YoY during the quarter, leading to a 79% increase in its profit. The remarketing business also showed strong momentum, with a 36% YoY top line growth and a substantial 258% YoY growth in profit.

CarTrade saw 75 Mn average monthly unique visitors in Q1, with 95% of the traffic being organic. Meanwhile, it also expanded its presence in 500+ physical locations, including Shriram Automall, CarWale abSure, Signature dealers, and OLX India franchisees.

MobiKwik’s Loss SurgesFintech major MobiKwik reported a sharp jump in its Q1 loss on Thursday. The company’s loss surged to INR 41.9 Cr during the quarter from INR 6.6 Cr in the year-ago quarter.

As a result, the stock tanked nearly 9% this week. MobiKwik’s shares have now plunged over 47% from its listing price of INR 442.25.

The company’s reliance on its payments business, which makes up 76% of its total income, and the slow recovery in the financial services segment led to a negative investor sentiment. The revenue of the financial services segment fell to INR 58.3 Cr, a 65% drop from a year ago. This decline was largely due to the discontinuation of the smaller-ticket ZIP product due to macroeconomic challenges.

However, MobiKwik’s ZIP EMI disbursals rose 31% QoQ. The company’s EBITDA loss also declined sequentially to INR 31.2 Cr in Q1 FY26 from INR 45.8 Cr. On the back of this, MobiKwik said it is “on path” to achieve EBITDA breakeven. However, it didn’t give a timeline for it.

The post New-Age Tech Stocks Slide As Bears Take Over D-Street, MobiKwik Drops The Most appeared first on Inc42 Media.

You may also like

'We're swapping £2,000 mortgage for £260 Airbnb - we've had enough'

'I'm a therapist and teach my kids to look out for these red flags in friends'

Mystery illness makes patient gouge own eyes out and turns children feral

Back to school accessories at lowest prices, including stationery, books and gadgets

Air fryer brownies will be 'fudgy, chocolatey and rich' if you follow 1 simple method