India’s $55 Bn food delivery market is witnessing its biggest disruption. A multi-front war is brewing – ignited by a state-backed revival strategy for ONDC and the emergence of Rapido as a new rival – to break the duopoly of Zomato and Swiggy. So, what’s cooking in India’s foodtech kitchen?

ONDC 2.0: To stir up ONDC’s stagnant orders, the government is lining up a dedicated INR 200 Cr to INR 250 Cr fund to dole out incentives to new restaurants joining the platform. As part of the strategy, the Centre has also directed eateries to offer discounts from the cost savings, resulting from little-to-no commissions on ONDC.

Rapido, The Dark Horse: Amid this ONDC-led disruption, Rapido is quietly building its food delivery platform, Ownly. What makes it a serious contender is its in-house logistics capabilities, focus on low-cost meals and its disruptive zero-commission model. Rapido also eliminates ONDC’s historical pain point of coordinating multiple operators per transaction.

Hard Time For Zomato-Swiggy? The developments come at a time when thebroader food delivery market is witnessing a slowdown. Consequently, the margins of both Swiggy and Zomato are thinning, user bases are shrinking, and any attempts to boost profitability via increased platform and delivery fees have been alienating consumers.

All said and done, industry insiders do not see the dominance of Swiggy or Zomato ending any time soon. They anticipate the two giants splurge more on retaining their market share. But, as the tide turns towards subscription-led models, are the days of the Zomato-Swiggy duopoly over?

From The Editor’s DeskAther’s Q1 Show: The EV major narrowed its net loss by 3% to INR 178.2 Cr in Q1 FY26 from INR 182.9 Cr a year ago. Its operating revenue jumped over 79% to INR 644.6 Cr in the quarter under review from INR 360.5 Cr in Q1 FY25.

Antfin To Exit Paytm: The Chinese tech giant is planning to offload its remaining 5.84% stake in One 97 Communications in an INR 3,800 Cr block deal. The company has liquidated about a 10% stake in the fintech major in the last three years.

Mitigata Raises $5.9 Mn: The cyber insurance startup has raised the funds in its Series A round led by Nexus Venture Partners. The startup leverages AI to offer cybersecurity and cyber insurance solutions to businesses as well as individuals.

TBO Tek’s Lukewarm Q1: The B2B travel tech company’s net profit rose a meagre 3% to INR 63 Cr in Q1 FY26 from INR 60.9 Cr in the year-ago period. Its operating revenue jumped 22% YoY to INR 511.3 Cr in the quarter under review.

Swiggy Floats DeskEats: The foodtech major has launched the new offering to cater to working professionals across India. DeskEats offers 7 Lakh menu items across a curated collection of value combos, stress munchies and one-handed grabies.

Centre’s EV Push: The government is likely to exempt electric vehicles from the 15-year ‘end of life’ regulation to spur the adoption of clean vehicles in the country. The EV penetration in India stands at 7.8%, much below the government’s target of 30% by 2030.

Kaynes’s INR 5K Cr TN Unit: The electronics manufacturer is planning to set up a factory in Tamil Nadu’s Thoothukudi, with an investment of INR 4,995 Cr. The unit will produce 74-layer PCBs, flexible PCBs, HDI PCBs, and high-performance laminates, among others.

Airtel’s Desi Cloud: The telecom major has rolled out its own sovereign cloud platform, which will offer locally controlled, AI-powered cloud infrastructure to Indian businesses. This follows Microsoft’s recent suspension of IT services to homegrown Nayara Energy.

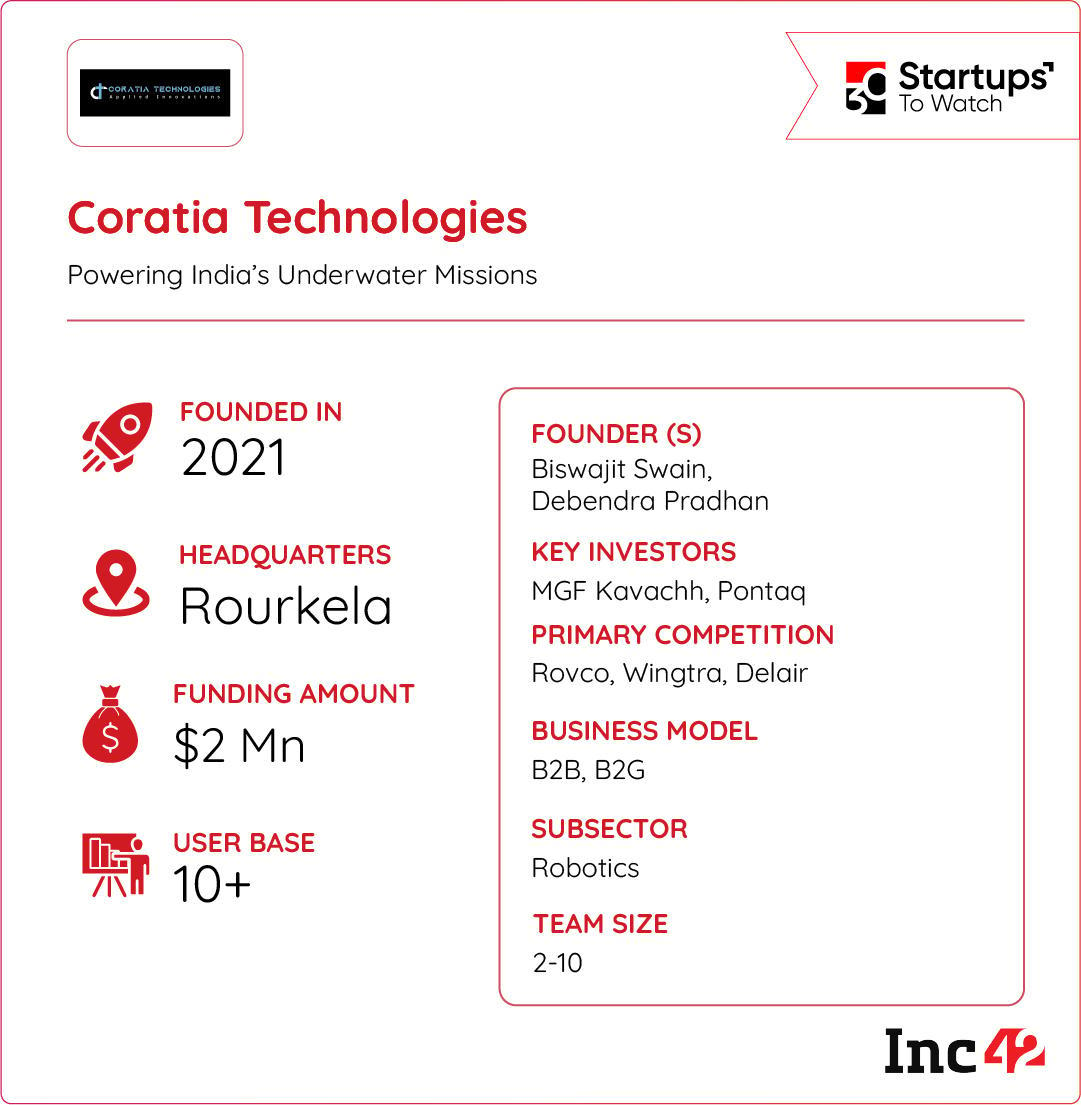

Inc42 Startup Spotlight Can Coratia Supercharge India’s Underwater Missions?Underwater exploration remains a challenge in India due to a lack of expertise in underwater engineering capabilities and technologies. Founded in 2021, Coratia Technologies is fixing these issues with its high-tech robots.

Powering Deep-Sea Expeditions: The Rourkela-based startup designs and manufactures remotely operated vehicles and autonomous underwater vehicles. Built for diverse underwater missions, these machines are capable of inspecting submerged infrastructure such as ship hulls, bridges, pipelines and dams.

Beneath The Surface: The startup caters to use cases across critical sectors like oil and gas, maritime logistics and civil infrastructure. Coratia also aids environmental research, underwater mapping, and search and rescue operations in hard-to-reach or hazardous zones.

Eye On The Market Pie: Operating in India’s underwater robotics market, which is projected to breach the $20 Bn mark by 2032, Coratia has already gained contracts from the Indian Navy, and also counts Tata Steel, SAIL, Indian Oil and Indian Railways as its clients.

As India rolls out the red carpet for homegrown deeptech technologies, can Coratia Technologies supercharge underwater exploration missions in the country?

The post The Foodtech Reset, Ather’s Q1 Show & More appeared first on Inc42 Media.

You may also like

'Don't sweep us under rug': Black man challenges Vivek Ramaswamy on violence, race - his response

Chef Manu Chandra Brings a Fine-Dining Twist to South Indian Flavours at the Siemens Experience Centre, Bangalore

Magic of AI on Facebook and Instagram: 3.4 billion people are using them daily..

Do you have ADHD? A Channel 4 documentary myth busts the signs and symptoms

Chris Hemsworth on performing with Ed Sheeran: Was out of body experience