India’s coworking sector is going through a boom. After the Awfis listing last year, Smartworks and IndiQube went public in 2025. Next up, the likes of WeWork India, DevX and The Executive Centre are waiting in the wings with their own IPOs.

WeWork India’s listing is being seen as the litmus test after the relatively smaller public issues in this sector as the company is expected to raise between INR 3,500 Cr and INR 4,000 Cr. With such a large potential issue, WeWork is definitely stoking the fires when they are already hot.

But as ever, the question is: is WeWork India actually a right investment for retail investors, particularly at the IPO stage?

That’s because WeWork’s issue is a 100% offer for sale (OFS), which should result in a profitable exit for existing investors, the Embassy Group and 1 Ariel Way Tenant, an affiliate of WeWork Inc.

Retail investors would be right in having concerns about WeWork India’s ability to fund its future growth, especially given its heavy lease obligations, as that is its primary business model.

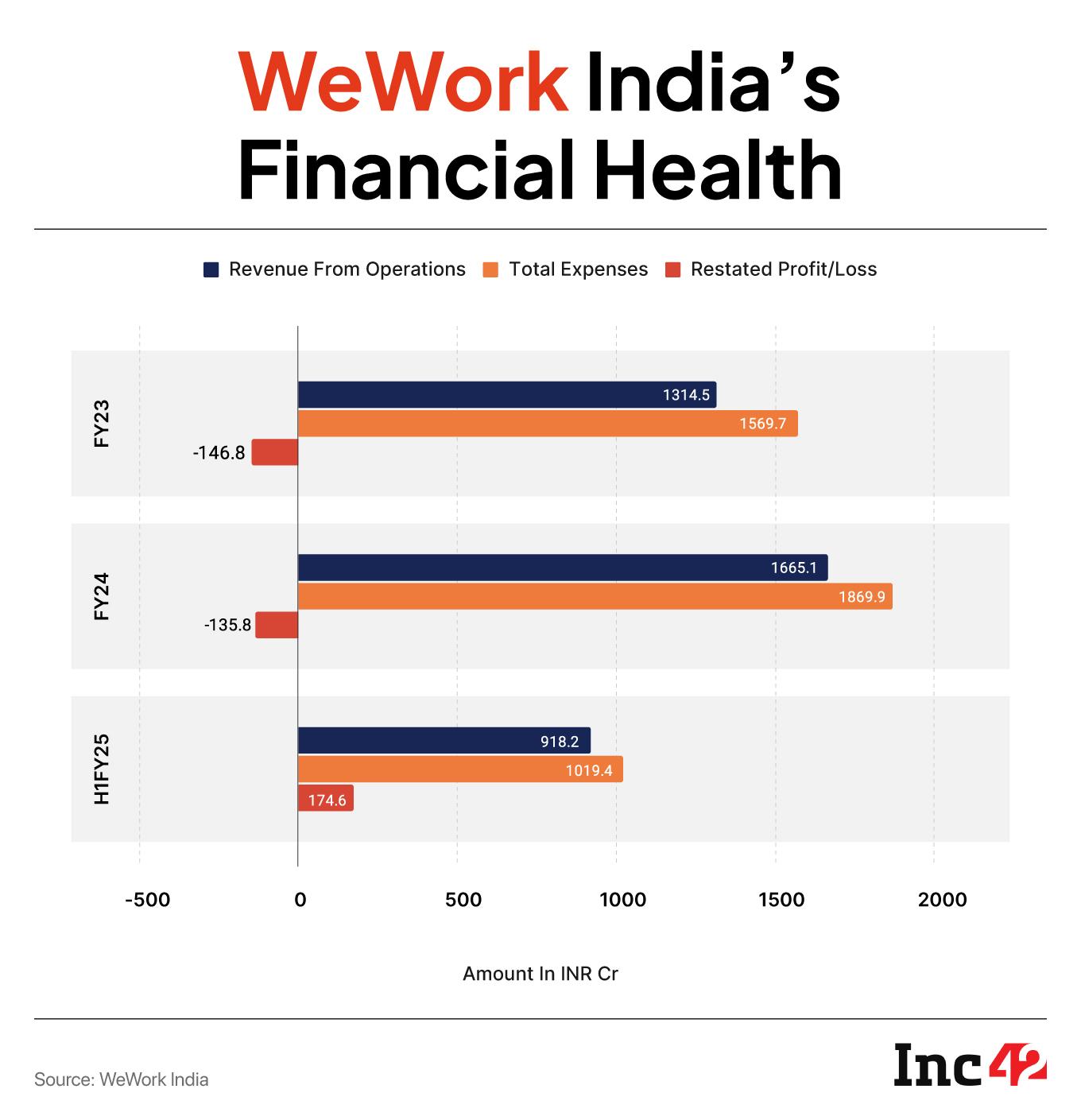

Despite reporting a restated profit of INR 174.6 Cr in H1 FY25, the company continues to have a negative net worth, the company continues to carry a negative net worth and remains highly concentrated in just two cities, Bengaluru and Mumbai, which together account for over 70% of revenue. So any concerns one might have about WeWork India’s IPO are not unwarranted.

Before we get to those, let’s briefly look at why coworking companies are rushing to public markets to raise funds.

According to Knight Frank India’s 2025 H1 report, the first half of 2025 saw remarkable growth in the flexible workspace sector, with operators leasing 10.2 Mn sq ft—a 43% year-on-year increase. Co-working spaces made up a significant 76% of total flex space absorption Organisational priorities have evidently changed in the post-pandemic economy, with many preferring to go for coworking spaces rather than leasing dedicated space.

Meanwhile, the demand from startups and SMEs has also grown due to the heavy investments in these segments, even outside the metros, and in Tier II and Tier III cities. Unsurprisingly, coworking companies are looking to cash in on this boom, but in different ways.

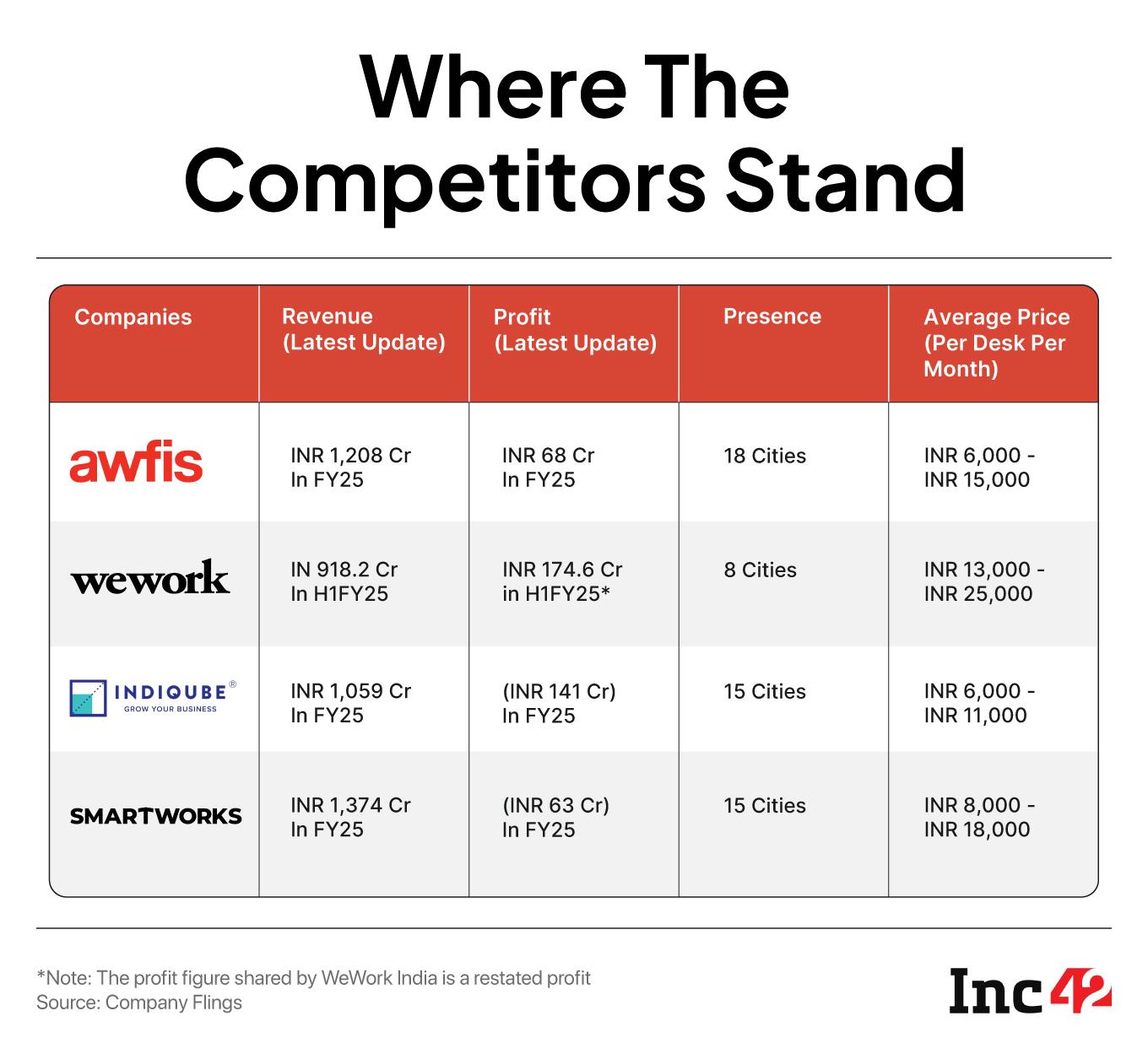

WeWork’s Seat In The Coworking SpaceWhile the likes of Awfis, Smartworks, IndiQube and WeWork India might be clubbed together under the coworking umbrella, each of these actually has a totally different model and business structure.

For one, WeWork India has the advantage of a massive real estate corporate entity supplementing the already renowned brand name. WeWork operates as a franchise in India with Bengaluru-based Embassy Group owning a majority share (74%) and WeWork Global only owning a minority stake in the Indian entity.

The company operates in a so-called premium “Grade A” niche with over 93% of its 59 centres being located in top cities and metros in India, hosting nearly 95,000 desks for multinational companies, enterprises and startups.

“WeWork primarily operates in metro cities, where costs are significantly higher. Moreover, their global pricing standards aren’t easily scalable in the Indian market, making it difficult for Indian corporates to adopt their services,” Prashanth Tapse, senior VP at Mehta Equities, said.

In contrast, companies like Smartworks and Awfis offer similar services at one-third or even one-fourth the cost, while still maintaining quality. That gives them a clear competitive edge, he added.

Incidentally, more recently, WeWork India has also entered the managed coworking space model. The blend of traditional leasing and managed spaces means WeWork has access to a wider variety of customers — going from enterprises to early-stage startups and one-person companies.

On the other hand, recently-listed IndiQube has a more asset-light model and signs long-term leases, often 10 years with a three-year lock-in.

Awfis prioritises the managed coworking space model in partnership with developers and has recently tried to make a big play for GCC clients. Lastly, there’s Smartworks, which focuses on leasing large properties and transforming them into managed campuses. The company targets large IT services enterprises, MNCs and global enterprises as customers.

In this regard, Smartworks is closer to WeWork India, in terms of operational complexity and potential benchmark for the IPO-bound company in the public markets, but there are some overlaps between WeWork and Awfis too.

What definitely sets WeWork apart is the big brand name. We all know about the downfall of WeWork Inc, which filed for bankruptcy in 2023 after once being valued at $47 Bn. Even though the company has managed to survive after a buyout in 2024, WeWork (outside India) is a shadow of its former self.

Sourav Choudhary, MD of Raghunath Capital, noted that after 2023, WeWork has shut down over 150 underperforming locations globally, renegotiated leases, and transitioned to an asset-light model.

“WeWork India, while not burdened by the same debt levels, has also started leaning into capital-light expansion. However, real gains will only be evident once more centers achieve EBITDA break-even and cash flow becomes self-sustaining,” he added.

In terms of shareholding, WeWork Global held close to 27% stake in the Indian entity, but the global entity’s efforts to fully divest before the IPO were called off in 2024, with the IPO coming into the picture.

Globally, the WeWork brand continues to carry the baggage of its troubled past, so the perception risk tied to the global brand persists.

“For institutional investors, especially those with strong ESG mandates, this means the bar will be set high. They will look for clear signals of robust governance, including an independent and empowered board, transparent financial reporting, and watertight audit practices. Any trace of related-party transactions, cross-subsidies, or opaque ownership structures could raise red flags,” Choudhary added.

But Is The Business Sound?Reputational damage to the global WeWork brand would not matter so much to investors in India, if the company has its fundamentals right.

In terms of costs, WeWork has to invest in fit-outs, design, and technology to convert these spaces into high-quality, flexible workspaces after signing long-term leases. This creates a high fixed-cost base where rent alone contributes to more than 43% of total operating costs.

A recent less cost-intensive addition is the “operator” or “management contract” model, where the company earns commissions from the usage of its brand name and services, but does not have any lease obligations.

Individual professionals, SMEs, startups, and large multinational enterprises sign short-term agreements with WeWork India and pay for monthly memberships, customisation, meeting room bookings, printing services, food and beverage services and event spaces.

Under the operator model, WeWork India manages properties on behalf of landlords and earns a fee without taking lease obligations. However, this is a minor revenue contributor currently.

Given the high fixed costs, WeWork has to ensure minimal occupancy risk across its properties, but there is a huge concentration of business in Tier 1 cities and with large companies.

For instance, Grade A commercial spaces in Tier 1 Indian cities like Bengaluru and Mumbai together contribute over 70.6% of its net membership fees as of H1 FY25, as compared to 68.80% revenue contribution for the full fiscal year of FY24.

Besides this, a significant share of WeWork India’s clients lease over 300 desks, often spread across multiple centres and cities in India. Such clients accounted for 39.08% of NMF in H1FY25 compared to 35.56% in all of FY24. The top 10 clients contribute over a quarter of the revenue, leaving the business susceptible to contract churn.

Plus, WeWork does not attract customers organically in all cases. Customer acquisition is through agencies that contributed nearly 57% of new desk sales in H1 FY25. This means higher costs due to attached commissions and weaker pull with customers.

While the company does invest in marketing and direct sales, gaining visibility in a highly competitive market remains an expensive challenge. We can expect the company to reduce its reliance on agents and index towards low-cost managed models in the medium term.

What This Means For The WeWork India IPO?Analysts say WeWork India will see strong retail participation, driven by a broader IPO frenzy and expectations of quick listing gains, but that’s just half the story. While the company holds strong brand recognition and operates in a sector gaining momentum, concerns around its global parent and financial sustainability temper some of this enthusiasm.

“There will be demand for this IPO — the application books will fill quickly,” InvestValue managing partner Kush Ghodasara said. “But from a long-term investment perspective, I’m not bullish. The sector is getting crowded, and sustaining margins in metros with rising real estate costs will be tough.”

However, there are some like Mehta Equities’ Tapse who are not even optimistic about the IPO getting a heavy subscription.

”These days, even retail investors do their homework. People will Google the company, look into its global history, and think twice. Many investors were burned in the past, and those missteps are still fresh in their minds. So yes, the global brand baggage will weigh heavily on investor sentiment,” the equities analyst added.

[Edited by Nikhil Subramaniam]

The post WeWork India IPO: Will Retail Investors See Any Upside? appeared first on Inc42 Media.

You may also like

Devil's Den murders: Parents killed shielding daughters; suspect arrested after 5-day manhunt

The £1.50 gardening hack to keep your plants watered while you are on holiday

Bengaluru lab fails to match woman's blood type to anyone, discovers first human with ultra-rare antigen that could revolutionize medicine

DWP change to Universal Credit and PIP 'could put 50,000 people into poverty'

Martin Lewis urges anyone on Universal Credit to get 50% savings boost